Tailored Sophistication for High-Net-Worth Investors

Overview

Smart HNW Portfolios are designed for discerning investors who want the full sophistication of ELITE’s risk-managed framework combined with the expertise of specialized equity managers selecting individual securities. Anchored by State Street Global Advisors’ capital market assumptions, dynamically adjusted by ELITE’s Investment Committee, and complemented by proprietary SALTS™ semi-liquid sleeves, these portfolios deliver an elevated, advisor-friendly solution for high-net-worth clients.

What Sets Smart HNW Apart

Specialized Equity Management - Third-party managers actively select and manage individual securities within defined mandates.

Targeted Opportunity – Capture specific market opportunities with precision equity exposure.

Deeper Research – Access fundamental insights from experienced, institutional-grade equity teams.

Dual-Layer Portfolio Design – Institutional asset allocation enhanced by manager-driven security selection.

The Smart HNW Experience

By combining institutional allocation, specialized equity selection, semi-liquid alternatives, and proactive oversight, Smart HNW Portfolios deliver a complete investment solution—engineered to preserve and grow wealth with precision.

Active Management

Tailored for high-net-worth investors, Smart HNW Portfolios combine ELITE’s risk-managed framework with expert third-party equity managers delivering individual securities into the portfolio.

Manager Strategists

Equity Sleeves

Income Sleeves

Risk Precision

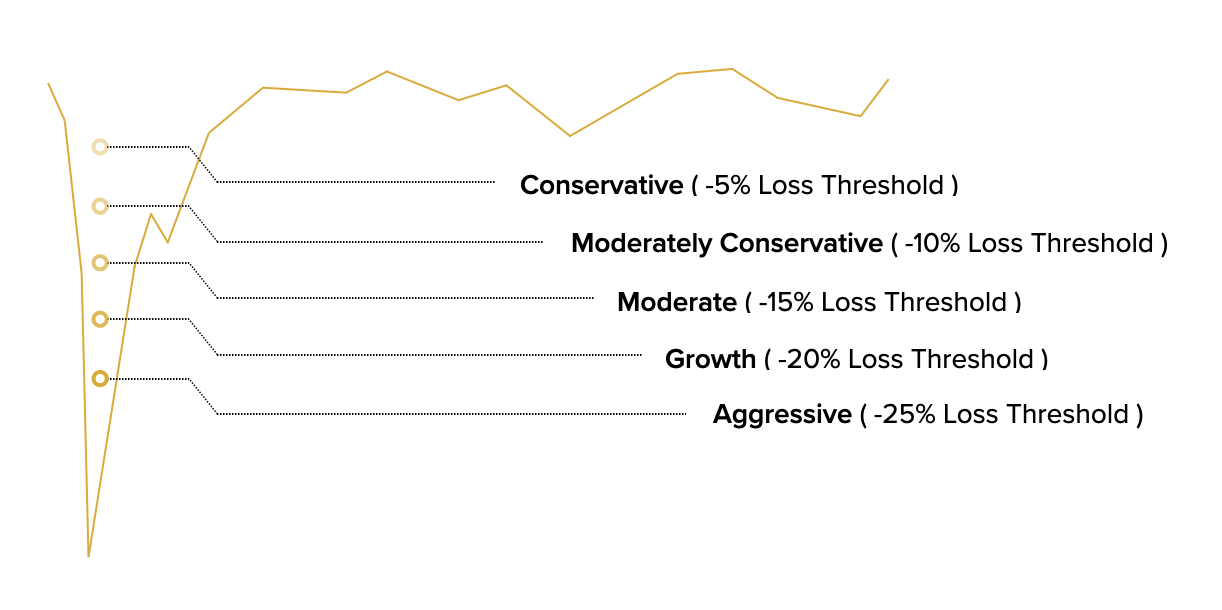

Smart HNW Portfolios are available across the full spectrum of maximum drawdown thresholds, from 5% (conservative) to 25% (aggressive)—allowing advisors to closely align client objectives with both growth and preservation.

Key Benefits for Advisors

Refined Client Fit – A differentiated solution for clients seeking a more sophisticated portfolio experience.

Enhanced Diversification – Integration of SALTS™ sleeves for additional return potential and downside management.

Seamless Implementation – Built to integrate easily into advisor practices and custodial platforms.

Institutional Credibility – Portfolios constructed and overseen with the same discipline as large-scale institutional mandates.

Ideal Client Fit

High-net-worth individuals seeking personalized equity exposure beyond traditional ETF and mutual fund allocations

Clients who value both institutional rigor and manager-driven security selection

Investors requiring customization with disciplined oversight and defined risk controls